Module 1: Strategic Management

Session 1: Introduction

Overview: Eight content areas

- Nature of Competition

- The 21st Century Competitive Landscape

- I/O Model of Above-Average Returns (AAR)

- Resource-Based Model of AAR

- Strategic Vision and Mission

- Stakeholders

- Strategic Leaders

- The Strategic Management Process

Boeing

Historically a global leader in airplane manufacturing

Revenue from commercial aircraft division & gov’t contracts

Regained supremacy in 2006: more 787 super jumbo orders vs. Airbus’s more efficient A-380

Changed strategy and design

Different production process

Smaller plane (787 Dreamliner)

Airbus

EU Government owned and subsidized

Won competitor battle with Boeing between 2001 & 2005

Responded to customer demands with more efficient A-380 aircraft

Nature of Competition: Basic concepts

Strategic Competitiveness:

Achieved when a firm formulate & implements a value-creating strategy

Strategy Integrated and coordinated set of commitments and actions designed to exploit core competencies and gain a competitive advantage

Competitive Advantage (CA):

Implemented strategy that competitors are unable to duplicate or find too costly to imitate

Above Average Returns(AAR):

Returns in excess of what investor expects in comparison to other investments with similar risk

Risk :Investor’s uncertainty about economic gains/losses resulting from a particular investment

Average Returns

Returns equal to what investor expects in comparison to other investments with similar risk

Strategic Management Process (SMP)

Full set of commitments, decisions and actions required for a firm to achieve strategic competitiveness and earn above average returns

The 21st Century Competitive Landscape:

Pace of change is rapid

Partnerships created by mergers & acquisitions (M&As)

Other CL characteristics: Economies of scale, advertising budgets not as effective as before, change in managerial mind-set from “traditional” to more flexible and innovative

Introduction: The Competitive Landscape (CL)

Hypercompetition – extremely intense rivalry among competing firms, characterized by

Escalating & increasingly aggressive competitive moves

Assumptions of market stability replaced with notion of INstability and change

Two primary drivers of the competitive landscape:

- The global economy

- Technology

- The Global Economy

Europe, through the European Union (EU) is the world’s largest single market

EU vs U.S. GDP: 35% higher

Emerging major competitive forces: China & India

In summary: globalization increased economic interdependence among countries as reflected in the flow of goods and services, financial capital, and knowledge across country borders

- Technology and Technological Changes

1. Technology diffusion & disruptive technologies:

Technology diffusion

Perpetual innovation: describes how new information-intensive technologies are replacing older forms

Speed to market may be primary competitive advantage

12 – 18 month timeframe to gather info re: competitor R&D

Disruptive technologies

Technologies that

Destroy value of existing technology

Create new markets

2.The information age

Dramatic changes over last several years

Major technological developments: computers, phones, artificial intelligence, virtual reality

Internet provides infrastructure for information anytime, anywhere

3:Increasing knowledge intensity

Defined as information, intelligence & expertise and is the basis of technology and its application

Gained through experience, observations and inferences

Strategic Flexibility – set of capabilities used to respond to various demands and opportunities existing in a dynamic and uncertain competitive environment

Industrial Organizational (I/O) Model of Above-Average Returns (AAR)

Basic Premise – to explain the dominant influence of the external environment on a firm's strategic actions and performance

Industrial Organizational (I/O) Model of Above-Average Returns (AAR)

Underlying Assumptions

- External environment imposes pressures and constraints that determine the strategies resulting in AAR

- Most firms compete within a particular industry/segmentControl similar strategically relevant resources Pursue similar strategies in light of those resources

- Resources for implementing strategies are highly mobile across firms.Therefore any resource differences between firms will be short-lived

- Organizational decision makers are rational and committed to acting in the firm's best interests, as shown by their profit-maximizing behaviors

Five-Forces Model (Michael Porter)

The 5 Forces includes Suppliers, buyers, competitive rivalry, product substitutes and potential entrants

Reinforces the importance of economic theory

Analytical tool previously lacking in the field of strategy

Determines the nature/level of competition and profit potential in an industry

Suggests an industry’s profitability is an interaction between these 5 forces

Limitations

Only two strategies are suggested:

- Cost Leadership:THE low-cost leader

- Differentiation:Customer willing to pay the premium price for ‘being different’Internal resources & capabilities not considered

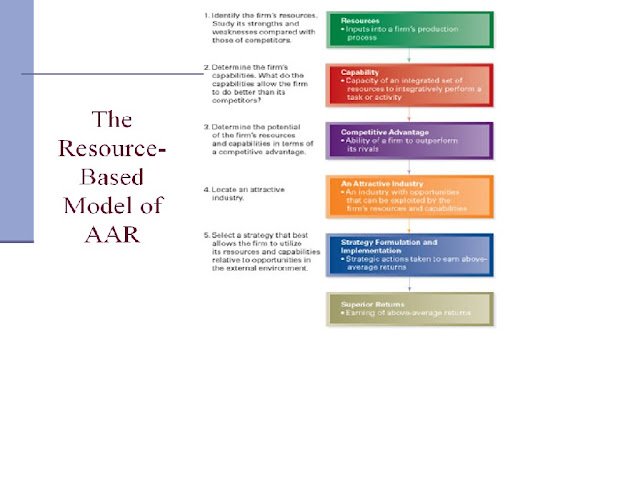

The Resource-Based Model of AAR

Each firm’s performance difference across time emerges (vs industry’s structural characteristics)

Combined uniqueness should define the firms’ strategic actions

Resources are tangible and intangible

Resources:

Inputs into a firm's production process Includes capital equipment, employee skills, patents, high-quality managers, financial condition, etc.

Basis for competitive advantage: When resources are valuable, rare, costly to imitate and nonsubsitutable

Internal/firm-specific resources

- Physical:Things you can touch/feel = tangible

- Human:People / employees

- Organizational capital:Relative to the firm itself

Capability

Capacity for a set of resources to perform a task or activity in an integrative manner

Core Competency

A firm’s resources and capabilities that serve as sources of competitive advantage over its rival

Summary

A firm has superior performance because of

Unique resources and capabilities, and the combination makes them different, and better, than their competition – driving the competitive advantage

Vision

Picture of what the firm wants to be What the firm ultimately wants to achieve

An effective vision statement is the responsibility of the leader who should work with others to form it

Foundation for the mission

Mission

Specifics business(es) in which firm intends to compete and customers it intends to serve

More specific than the vision

Stakeholders

Basic Premise – a firm can effectively manage stakeholder relationships to create a competitive advantage and outperform its competitors

Stakeholders are individuals and groups they can affect, and are affected by, the strategic outcomes/performance a firm achieves

Three (3) classifications :

Classifications of Stakeholders

- Capital Market Stakeholders:

- Share holders

- Major Suppliers(e.g. Banks and Creditors)

Higher the dependency relationship, the more direct and significant firm’s response

- Product Market Stakeholders:

- Primary Customers

- Supplicers

- Host Communities

- Unions

- Organizational Stakeholders:

- Employees

- Managers

- Nonmanagers

Strategic Leaders

People located in different parts of the firm using the strategic management process to help the firm reach its vision and mission

Decisive and committed to nurturing those around them

Create and sustain organizational culture

Organizational culture emerges from & sustained by leaders

Complex set of ideologies, symbols and core values shared throughout the firm

Affects leaders/their work which in-turn shapes culture

Influences how the firm conducts business

The Work of Effective Strategic Leaders:

Work long hours.Must be able to “think seriously and deeply…about the purposes of the organizations they head or functions they perform, about strategies, tactics,…..and people…and about the important questions … they need to ask.”

Predicting Outcomes: Profit Pools (PP)

Anticipates their decisions relative to the PP

Entails the total profits earned in an industry at all points along the value chain

Strategic Management Process

Rational approach used by firms to achieve strategic competitiveness and earn above average returns (AAR)

This comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteE book for SM:

ReplyDeletehttp://books.google.co.in/books?id=ul5FsIlWa3EC&pg=PA81&lpg=PA81&dq=Four+specific+criteria+of+Sustainable+CA&source=bl&ots=2U6bIzGTNA&sig=m7RD5PPo-oQheTlWz5V9-fdNmrY&hl=en&ei=KoVzTIK7C4-wvgOSvsX9Dg&sa=X&oi=book_result&ct=result&resnum=1&ved=0CBsQ6AEwAA#v=onepage&q&f=false